- Solid Right

- Posts

- Yeild-Bearing Stablecoins

Yeild-Bearing Stablecoins

Passive Profit Returns?

A Message From Our Sponsor … 🚀

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

GET IT RIGHT 🎯

Turbo-Charged Stablecoins 🧨

If you’ve been holding traditional stablecoins like USD Coin (USDC) or Tether (USDT), your digital dollars may be safe—but they’re also doing nothing. In an inflationary environment, that idle stability comes at a cost. Yield-bearing stablecoins flip that equation by combining a familiar 1:1 U.S. dollar peg with built-in, automatic yield.

Think of them as stablecoins with a pulse: no staking dashboards, no lending hoops, and no manual reward claims. The yield simply accrues in the background while you go about your day.

Liquid Yield 💴

What makes yield-bearing stablecoins compelling is how seamlessly they behave like cash. They remain fully spendable for payments or DeFi transactions, can be composed directly into other protocols without wrappers, and are immediately usable as collateral for loans or margin. Many are also merchant-friendly, already supported by major crypto payment cards. The result is a hybrid instrument that blurs the line between pocket money and a low-risk capital asset—earning yield without sacrificing liquidity.

Of course, yield doesn’t appear out of thin air. The most durable returns come from real, economically grounded sources rather than speculative incentives. One dominant model wraps real-world assets, particularly short-term U.S. Treasuries and bank deposits, into tokenized form.

Higher Value 💱

Platforms like Ondo Finance issue tokens such as USDY, where interest earned by the underlying assets steadily pushes the token’s value higher, typically producing annual yields in the 4% to 5% range.

Yield-Bearing Stablecoins

Another approach relies on protocol revenue sharing. Sky Protocol (formerly MakerDAO) generates income through Treasury holdings, stability fees from over-collateralized loans, and liquidation penalties. Its yield-bearing stablecoin, sUSDS, passes those earnings directly to holders, producing yields around 4% while remaining closely tied to institutional-grade risk profiles.

Surprising Simplicity 🟢

More strategy-driven models push further into crypto-native territory. Ethena’s sUSDe, for example, uses a delta-neutral strategy by staking ETH for yield while simultaneously shorting ETH futures. This captures staking rewards and funding fees regardless of market direction, resulting in yields slightly above 4%—though with added structural complexity.

Across all these models, the mechanics are refreshingly simple. The yield is embedded in the token’s price. If you buy 1,000 units at $1.00 each and the token earns 5% over a year, you still hold 1,000 units—but each is now worth $1.05. No claims, no clicks, no friction.

Assessing Risk 💵

Risk profiles vary. Institutional-leaning options like sUSDS and USDY offer conservative, treasury-style exposure. Strategy-oriented tokens such as Maple’s SyrupUSDC and SyrupUSDT push yields into the 5% range by optimizing on-chain lending. At the higher-risk end, products like sUSDai and Huma Finance’s PST offer yields near or above 9%, appealing to experienced users comfortable with more moving parts.

Choosing whether to participate comes down to risk tolerance and regulatory context. But one thing is increasingly clear: in 2025, holding a zero-yield dollar isn’t neutral anymore. It’s an active decision to fall behind.

COIN SPOTLIGHT 🔍️

Ripple’s Makeover 🏗️

For years, crypto purists dismissed Ripple as the suit-and-tie outsider—too regulated, too corporate, and far removed from the anarchic spirit of DeFi. While traders chased yield farms and meme coins, Ripple Labs quietly built something far less flashy but far more durable: enterprise-grade financial infrastructure.

That patience paid off in late 2025 with a $500 million strategic investment led by Citadel Securities and Fortress Investment Group, lifting Ripple’s valuation to roughly $40 billion. The message was clear: Ripple has evolved from crypto startup to global financial utility, and the ripple effects are finally reaching XRP.

The Great Decoupling 🧲

A persistent myth among retail investors is that Ripple’s corporate valuation and XRP’s market cap are inseparable. Post-2025, that assumption no longer holds. The new capital bought equity—not XRP—and funded a company that has spent more than $4 billion acquiring treasury management platforms, custody services, and prime brokerage infrastructure.

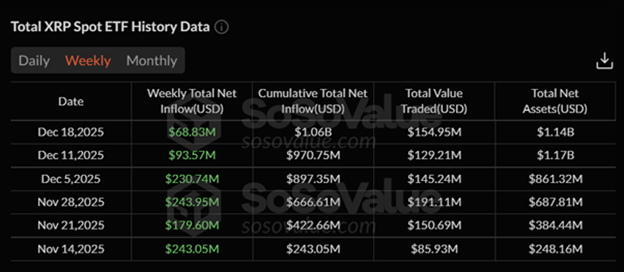

XRP Spot EFT Data

As CEO Brad Garlinghouse put it, the investment validated both Ripple’s momentum and the scale of the opportunity ahead. For XRP holders, the significance is indirect but powerful: each enterprise treasury that integrates Ripple’s stack creates a new utility pathway for the token, even if XRP isn’t the headline product.

Acquisition Engine 🚂

Ripple’s acquisition strategy reached a crescendo in October 2025 with its $1 billion purchase of GTreasury, a platform processing more than $12.5 trillion in annual payment flows for Fortune 500 companies such as American Airlines and Volvo. Integrating Ripple’s settlement rails into those workflows enables CFOs to move liquidity around the clock—no bank hours required.

Earlier that year, Ripple acquired Hidden Road, now rebranded as Ripple Prime. The move tripled business volume and pushed daily transactions beyond 60 million, while introducing XRP-collateralized lending—a structural demand source absent in prior cycles.

The capstone came on December 12, 2025, when the Office of the Comptroller of the Currency granted conditional approval for Ripple National Trust Bank. Operating under dual federal and state oversight, the trust bank dramatically lowers compliance friction for traditional institutions exploring blockchain settlement. Early adopters like Europe’s AMINA Bank demonstrate that even conservative financiers are warming to the model.

Balance Sheet 📊

As of December 2025, Ripple controls roughly 39 billion XRP across escrow and operational wallets—worth nearly $78 billion at current prices. That means investors are buying equity priced below the company’s net digital asset value, before accounting for licenses, software revenue, and infrastructure reach.

XRP Trend Chart

Market Signals 🚥

Institutional access is now firmly established. Regulated spot XRP ETFs have accumulated more than $1.14 billion in assets—nearly 1% of circulating supply—with consistent weekly inflows. This isn’t speculative hype; it’s portfolio allocation.

The Takeway 🥡

Ripple’s $40 billion valuation reflects confidence in a regulated financial stack, not a bet on short-term XRP price action. Volatility remains, but XRP’s long-term trajectory is now tied to institutional adoption rather than retail speculation. The corporate world has finally RSVP’d to the XRP party—and it’s planning to stay.

NOTABLE QUOTES 📚️

“What would life be if we had no courage to attempt anything?”

— Vincent van Gogh

GARAGE LOGIC ☕️

FINAL SPIN 📽️

STAGE RIGHT 🎬️

SOLID RIGHT VIP 🗝️

Be sure to check out Solid Right VIP It’s your inside track to the latest moves in Ethereum, Bitcoin, and beyond—delivered with clarity, context, and zero hype.

Join now and get 50% OFF forever. Go HERE.

LAST CHAPTER 📺️

Get it Now …

WEALTH ON AUTOPILOT

A Simple System That Builds Wealth While You Sleep (No Market Timing, Stock Picking, or Financial Degree Required

Read it in a weekend. Implement it in 30 days. Run it for 30 years. No daily decisions. No constant monitoring. Just automated wealth-building that turns steady earners into millionaires while you live your life."

WE HAVE LAUNCHED. ORDER HERE.