- Solid Right

- Posts

- The Next Big Thing

The Next Big Thing

Stocks On-Chain

A Message From Our Sponsor … 🚀

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

GET IT RIGHT 🎯

Tokenize Everything 🪴

“Tokenization” has become one of those words people toss around at conferences to sound smart. But while everyone’s busy tokenizing art, real estate, and maybe their dog, there’s one category that could actually matter: stocks.

Yes, those boring, dividend-paying relics your grandpa used to brag about. But this time, they’re going on-chain.

Stock tokenization means turning traditional company shares—like Apple or Tesla—into digital tokens that live on a blockchain. Each token still represents ownership in the company, just like a regular share, but now you can trade it 24/7, settle instantly, and manage it directly from your wallet. No middlemen. No waiting three days for your “cleared funds.” No smug brokerage commercials.

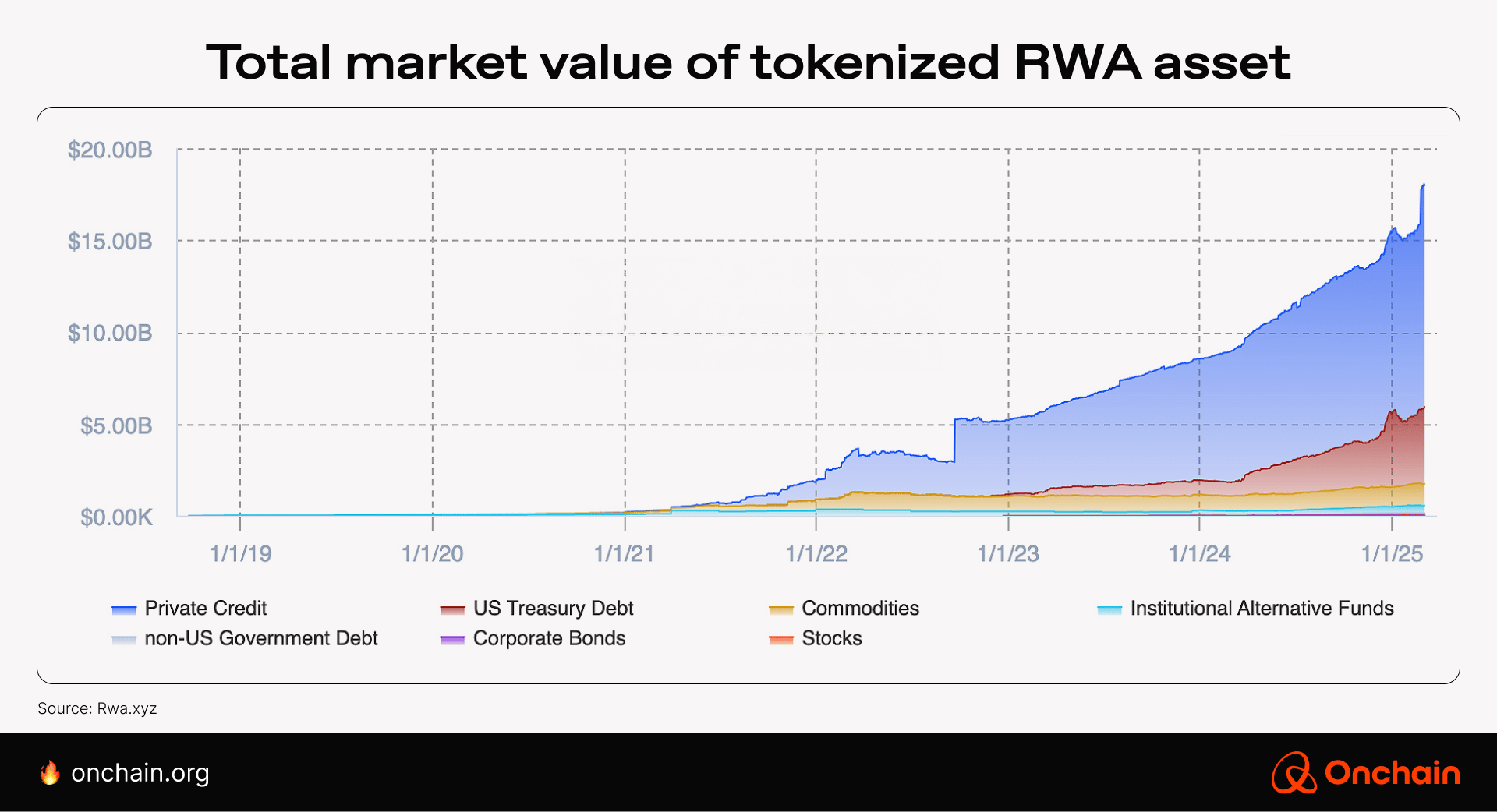

Total Market Value

And here’s why it’s a big deal:

The global stock market is worth over $100 trillion. That’s trillion with a “T.” The U.S. alone accounts for more than $60 trillion of that. So if you’re looking for the biggest domino to fall, it’s not NFTs or Dogecoin—it’s Wall Street.

Yet, despite the trillion-dollar hype, the current reality looks more like a toddler’s lemonade stand: only about $400 million worth of tokenized stocks exist on-chain right now. That’s 0.0004% of the total market—aka “still finding its shoes.”

But change is brewing. After years of red tape and regulatory fog, the U.S. is finally showing signs of thawing toward blockchain innovation. A handful of pioneers are already bridging the gap between Wall Street and Web3, using two main models:

Asset-Backed Tokens 💴

Think of these as digital twins. A licensed company buys real shares, holds them in custody, and issues tokens backed 1:1 by those stocks. You can even redeem your tokens for the real deal if you’re feeling nostalgic.

Backed Finance in Switzerland is leading the pack here, offering tokenized versions of Tesla, Apple, and others. You can find them on Ethereum or Solana—because of course you can.Synthetic Stocks 💱

Instead of holding real shares, synthetic tokens track stock prices using collateral and smart contracts. It sounds neat—until it isn’t. Terra’s Mirror Protocol tried this, but when Terra imploded, those “mirrored” assets vanished faster than your crypto portfolio in May 2022. Lesson learned.

So what’s next?

As regulation catches up, real-world stock tokenization could explode, unlocking around-the-clock trading, instant settlement, and global access. Imagine buying Apple stock while standing in line for coffee in Singapore or using your tokenized S&P 500 shares as collateral for a DeFi loan.

We’re not quite there yet—but we’re close. And when $100 trillion worth of assets start migrating to blockchains, you’ll wish you’d paid attention when “tokenization” still sounded like a buzzword.

The Boom Begins 🧨

We just discussed how stock tokenization is quietly reshaping traditional finance. But that’s only one piece of the puzzle. The broader wave of tokenization is set to reach far beyond equities.

Now, let’s zoom out. Because tokenized stocks are just the opening act in what’s shaping up to be a full-blown tokenization frenzy.

Enter: the RWA market — Real-World Assets for those not fluent in crypto acronyms (congrats on having a social life).

Estimated Tokenization Growth

We’ve been saying it since April: the crypto IPO era is here.

And the latest company stepping into the spotlight is Securitize — with the truly unfortunate ticker, $SECZ.

Yes, $SECZ. Nothing says “trust us with your portfolio” like a ticker that sounds like an adult website.

But here’s the thing: Securitize is no joke. Their entire business revolves around bringing real-world assets — things like stocks, bonds, real estate, and collectibles — onto the blockchain. In other words, they’re helping turn everything with a price tag into a tradable, digital token.

It’s not just about novelty. The benefits are actually massive:

Tokenized assets can trade globally 24/7, attracting more liquidity.

They move faster and cheaper than on legacy rails.

And every on-chain trade means more fees — and more demand — for the underlying blockchain’s native token.

In short: more tokenized stuff = more blockchain activity = line go up.

Right now, the total market for tokenized RWAs sits around $600 billion (or as the financial elite would say, a humble $0.6 trillion).

Not bad — but still small fries compared to what’s coming next.

Analysts are projecting this sector to 30x over the next eight years.

Yes, thirty-fold.

As in: if you blink, your grandpa’s boring bond portfolio might suddenly be living on a blockchain and yield-farming on the weekends.

So, who stands to benefit most from this trillion-dollar flood of tokenized money?

Ethereum.

Love it or hate it, the old gas-guzzler still dominates the RWA sector, and it’s probably going to stay that way — at least for now.

Most tokenized assets live on Ethereum because it’s battle-tested, institutionally palatable, and already hosts the majority of stablecoin and DeFi infrastructure.

Sure, newer chains like Avalanche, Polygon, and Base are throwing elbows for market share — but when the biggest institutions start moving trillions in RWAs, they’ll likely stick to the chain that doesn’t break every other Tuesday.

So yes, Securitize might have an awkward ticker, but they’re playing in what could become one of the biggest growth markets in crypto history.

The next wave of tokenization isn’t just about trading faster or cheaper — it’s about rewiring how global assets move altogether.

$600 billion today. $18 trillion tomorrow.

And somewhere out there, Ethereum is quietly warming up its gas fees.

COIN SPOTLIGHT 🔍️

How to Play Your Capital 💰️

If you’ve been in crypto longer than five minutes, you know the cycle: despair, disbelief, boredom, and then — out of nowhere — the bounce.

And make no mistake, it’s coming.

But here’s the thing: when it does, don’t expect your dusty old bags to suddenly moon again. The next wave never rides the same horses twice. New ideas, new narratives, and new tokens will lead the charge — and if you’re still clutching 2021’s winners like a security blanket, you’ll miss the next convoy entirely.

So how do you play it?

RULE ONE: Wait for the real reversal. You’ll feel it — the shift in tone, the sudden rush of optimism, the moment everyone starts pretending they “saw it coming.”

RULE TWO: When capital rotates, rotate with it. Loyalty kills in the trenches.

RULE THREE: Stay curious, stay liquid, and when it’s time… swing hard.

This isn’t romance. It’s war. Don’t marry your bags. Date them casually, exit when they start acting weird, and always keep cash for the next fling.

Three Long-Term Plays ⚽️

Short-term plays are fun — but let’s zoom out. A few ecosystems still stand tall, bear market or not.

Prediction Markets 🎲

I’ve been shouting about these since before it was cool. Platforms like Polymarket and Kalshi are reshaping the future of betting — narrative-driven, global, and absurdly addictive.

Even when the hype dies down (and it will), prediction markets will keep printing opportunities for anyone early to the news. You don’t have to be right all the time, just right before everyone else.

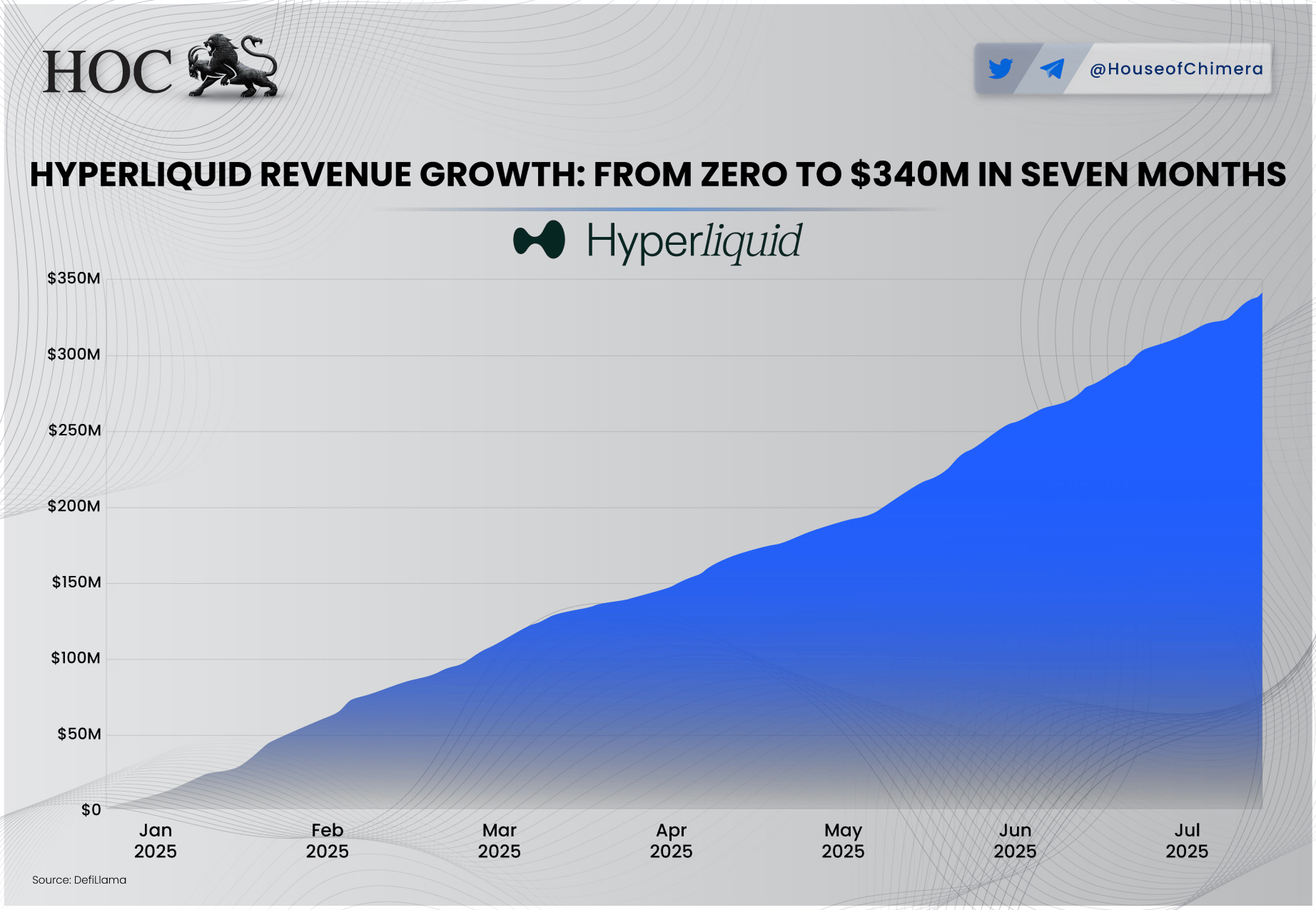

Pick a niche (politics, sports, meme-wars), bet small, learn fast. This vertical isn’t going away — it’s just getting smarter.Hyperliquid ($HYPE) 🌊

Yes, it pulled back. And yes, I still love it. Hyperliquid is the first platform that actually makes DeFi trading feel like TradFi speed — clean, fast, and borderline addictive.

If $HYPE ever dips into single digits, I’ll be buying with both hands. It’s giving early-Solana vibes: low user count, high conviction, and plenty of upside. Keep trading, keep stacking points, and don’t forget — the airdrop gods favor the persistent clickers.

HYPERLIQUID

MegaETH 🏧

Now this one’s pure speculation — and I mean that lovingly. The chain isn’t even live yet, but the team’s design decisions scream “potential L2 contender.”

Their December launch campaign could make waves if they deliver. Think of it as “Solana’s brainchild raised on Ethereum discipline.” Big if true.

The Takeaway 🥡

We’ll see more airdrops. We’ll see new narratives. We’ll watch the impatient rage-quit right before things get interesting.

But if you’re still here, still reading, still showing up — congrats. You’re already ahead of 90% of the market.

STAGE RIGHT 🎬️

NOTABLE QUOTES 📚️

“Keep your attention focused entirely on what is truly your own concern, and be clear that what belongs to others is their business and none of yours.”

— Epictetus

GARAGE LOGIC ☕️

The Day You Were Born. 📆

With this website, you can search old headlines and see what kind of news day it was on your birthday. Maybe a historic event took place—or maybe it was just another Tuesday. Either way, it’s pretty cool to find out what the world was talking about when you arrived.

Find out HERE.

FINAL SPIN 📽️

LAST CHAPTER 📺️

Coming SOON:

WEALTH ON AUTOPILOT

A Simple System That Builds Wealth While You Sleep (No Market Timing, Stock Picking, or Financial Degree Required

Discover the exact "set-it-and-forget-it" strategy that quietly transforms ordinary earners into millionaires even if you've never invested a dollar before.

STAY TUNED …

SOLID RIGHT VIP 🗝️

Be sure to check out Solid Right VIP It’s your inside track to the latest moves in Ethereum, Bitcoin, and beyond—delivered with clarity, context, and zero hype.

Join now and get 50% OFF forever. Go HERE.