- Solid Right

- Posts

- Sustainable Surge ...

Sustainable Surge ...

Or Sugar Rush?

A Message From Our Sponsor … 🚀

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

GET IT RIGHT 🎯

Time to Buckle Up 🚀

Crypto has kicked off 2026 like it downed three energy drinks, skipped the warm-up, and sprinted straight out of the tunnel. Prices are ripping higher, charts are glowing green, and optimism is spreading faster than bad trading advice on social media.

But the obvious question remains: is this rally built to last, or is it about to faceplant?

The Numbers 🔢

Let’s start with the numbers—because they’re doing a lot of the talking right now. In the first two trading days of the year alone, traditional finance funneled $1.16 billion into Bitcoin ETFs. At the same time, the total crypto market cap ballooned by roughly $250 billion in just five days.

Big numbers tend to lose meaning after a while, so here’s the part that snaps things back into focus: during the final three months of 2025, crypto lost about $920 billion in total value. In the first five days of 2026, it clawed back 27% of that drop. That’s not a gentle recovery—it’s a full-on sprint.

Anyone’s Guess ❓️

Naturally, gravity has entered the chat. Markets don’t move in straight lines forever, and anyone claiming they know exactly what happens next with absolute certainty should be treated with healthy skepticism—and possibly a helmet.

In the short term, no one actually knows. Treat anyone/everyone that combines blind confidence with zero nuance as if they’re this guy.

Mr. Reliable

Volatility is part of the deal. But over the long term, macroeconomic trends can at least suggest which direction the wind is blowing. And right now, that breeze feels suspiciously bullish.

Market Easing ⛵️

First, quantitative tightening appears to be over. In plain English, the Federal Reserve has stopped actively pulling money out of the system. Quantitative easing—aka nudging money back into markets—has returned, albeit as more of a polite drizzle than a fire hose. Still, liquidity trickling back into the system is rarely bad news for risk assets.

Second, employment and inflation are showing signs of softening. That may sound gloomy, but weakening economic data often nudges central banks toward interest rate cuts. Lower rates mean cheaper money, and cheaper money tends to wander into asset markets. While an immediate rate cut isn’t guaranteed, upcoming jobs and inflation reports could shift expectations quickly.

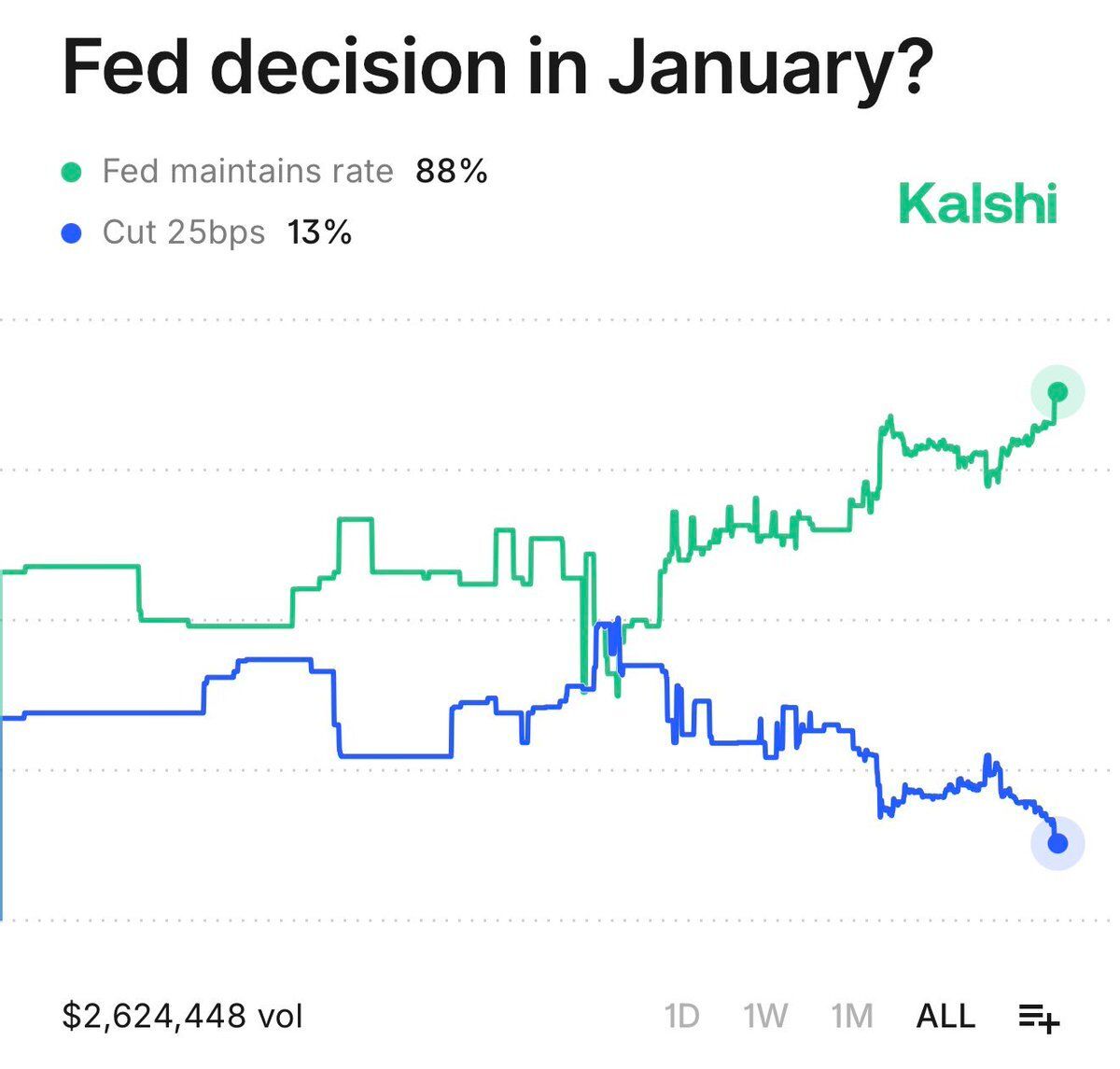

Right now, the likelihood of a January rate cut ain’t looking too good:

Rate cut odds

Upward Trajectory? 🛸

Finally, this isn’t just a U.S. story. Nearly 80% of global economies are currently in easing mode, making money more accessible for consumers and businesses. More liquidity globally means more capital hunting for returns—and crypto remains very much on that list.

Put it all together, and the macro outlook for 2026 is pointing upward. Not forever. Not without bumps. But for now, the conditions are supportive.

The Takeaway 🥡

So yes, the charts are green. The vibes are optimistic. And the market is being cheered on with the enthusiasm of an overinvested stage parent yelling encouragement from the front row.

Just don’t forget: even the fastest sprints eventually require a breather.

COIN SPOTLIGHT 🔍️

Crypto Scorecard 📉

While the crypto market itself spent 2025 oscillating between euphoric and existential, publicly traded crypto companies delivered a performance spectrum that ranged from “nailed it” to “please don’t look at the chart.” Breaking down the year by category reveals where investors were rewarded—and where optimism went to quietly rethink its life choices.

Let’s start with the heavyweights.

The Big Boys 🐂

These are the established names: U.S.-listed, crypto-first, and large enough to move markets—or at least headlines.

Robinhood led the pack with a staggering +192.52% return, reminding everyone that retail trading never truly dies—it just reloads. Galaxy followed at +38.39%, buoyed by its dual exposure to crypto mining and AI compute, a combination Wall Street currently finds irresistible.

Then things got awkward. Coinbase finished down -3.31%, proving that being the face of crypto trading doesn’t guarantee stock-market affection. Circle slid -9.75%, despite issuing one of the most widely used stablecoins on the planet. And Strategy (formerly MicroStrategy) brought up the rear at -46.27%, continuing its tradition of being less a company and more a highly leveraged Bitcoin thesis wearing a ticker symbol.

Ethereum DATs 🏦

Next up: companies whose primary mission is to acquire ETH and generate yield—no side hustles allowed.

BitMine absolutely stole the show with a +351.71% return, making it the clear winner and the reason this category exists in the first place. SharpLink posted a modest +18.63%, while The Ether Machine barely stayed positive at +6.63%.

On the other end of the spectrum, Bit Digital fell -32.85%, and ETHZilla lived up to its name by stomping shareholder hopes down -58.75%. Ethereum treasuries, it turns out, are not a guaranteed cheat code—execution still matters.

Crypto IPOs 💷

Finally, the fresh faces—companies brave enough to go public in a year where crypto sentiment changed weekly.

Figure led the IPO class with +22.89%, quietly outperforming while staying out of the drama. Circle reappears here with a -9.74% return, consistent if nothing else. Bullish dropped -37.32%, eToro slid -45.61%, and Gemini rounded things out at -63.27%, delivering a humbling reminder that brand recognition does not equal stock performance.

The Big Picture 🖼️

Taken together, 2025 made one thing clear: “crypto company” is not a single trade. Size didn’t guarantee safety. New listings didn’t guarantee upside. And holding digital assets on a balance sheet didn’t guarantee brilliance.

As 2026 gets underway, the market isn’t asking whether crypto is back—it’s asking which business models actually work. And judging by last year’s returns, that answer is still very much under construction.

NOTABLE QUOTES 📚️

“Fascism, Nazism, Communism, and Socialism are only superficial variations of the same monstrous theme — collectivism.”

— Ayn Rand

GARAGE LOGIC ☕️

FINAL SPIN 📽️

LAST CHAPTER 📺️

Get it Now …

WEALTH ON AUTOPILOT

A Simple System That Builds Wealth While You Sleep (No Market Timing, Stock Picking, or Financial Degree Required

Read it in a weekend. Implement it in 30 days. Run it for 30 years. No daily decisions. No constant monitoring. Just automated wealth-building that turns steady earners into millionaires while you live your life."

WE HAVE LAUNCHED. ORDER HERE.