- Solid Right

- Posts

- Over Age 40?

Over Age 40?

There's Still Time to Build Significant Wealth

Editor's Note

It’s not too late.

The Beauty of Compounding

Here’s something to ponder.

It’s an example of how much wealth can compound over time.

The criteria?

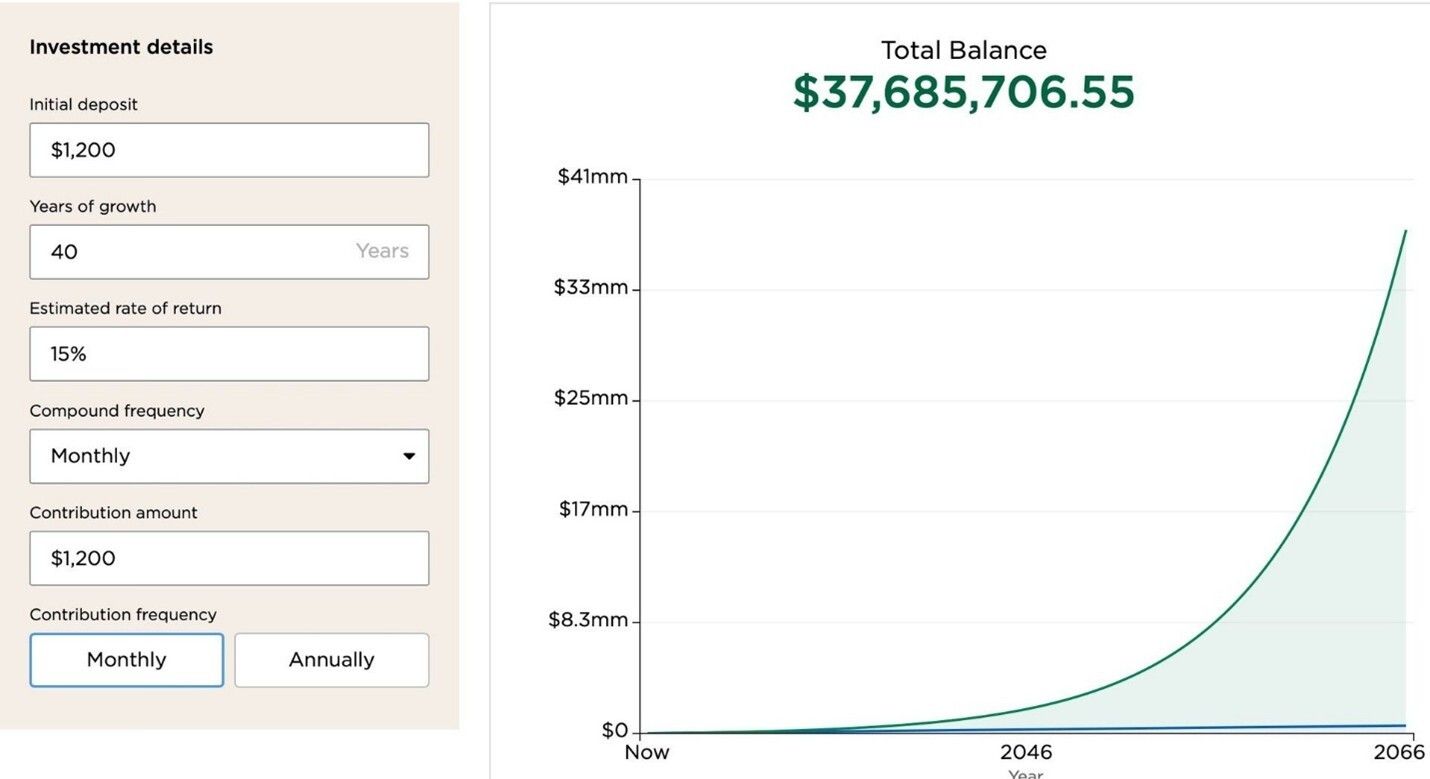

It illustrates what can happen if someone invests just $1,200/Mo (that’s just $300/week), with an average annual return of 15%, over a 40 year time period.

And as you can see, that turns into more than $37,000,000.

But the moment I say “40 years”, I can hear the groans.

“But, I’m already in my 40’s or 50’s, I don’t have another 40 years left!”

And my answer is… “Yes, actually you do… And in fact you’d better plan on it…”

So here are the facts.

Health and Longevity technology is advancing at an exponential rate… If you’re alive 10 years from now, there’s a very good chance you’ll have the ability to live to 100, or even longer.

And with a significantly higher quality of life than we’d expect when we look at people who are 80+.

The absolute worst situation you can run into is planning to die in your 70’s when you actually have another 20-30 years of life left to go.

So if you’re in your 40’s or even 50’s and you’re behind on your investment goals right now, it’s not too late because a 40-year-old today will have another 50-60 years of life left, and a 50-year-old will have another 40-50.

Once that realization hits you, a 40-year compounding timeframe becomes a very real thing you must plan on.

But You Must Avoid The “Catch Up” Trap At All Costs

If you feel like you’re behind on your retirement goals, that causes stress.

Stress causes people to make emotional, irrational decisions, and when you mix emotional decisions with money, you get destruction.

If you’re 40+ and you’re behind on your finances, you’re going to feel pressure to catch up… That’s just the reality of the situation.

But “Catching Up” For Most People Means They’re Going To Feel The Need To Pursue Higher Risk, Higher Reward Opportunities.

It means they’re going to get emotionally involved in their investments.

It means they’re going to sell at the first hint of a slowdown, only to buy back in later at a higher price.

And ultimately, these high-risk, high-reward bets end up on the losing side, putting them even further behind.

I cannot stress this enough.

If you are 40+ and feel like you’re behind, you cannot afford to take MORE risk… And in fact, you need to take significantly less.

Can you afford to lose what you currently have?

No?

Then you need to be ultra-conservative and let TIME… That extra 30-50 years I just gave you… Do its thing.

The single best way to catch up is to reduce your expenses, guard what you have, and then focus on ways to increase your income.

Remember… It doesn’t take much.

Just an extra $300 per week can turn into $8.4 million in 30 years.

Here’s How You Can Significantly Increase Your Average Returns And Speed Things Up Without Taking More Risk.

The average return for the S&P 500 is about 10% per year… So how did I land on a target of 15%?

Simple.

What if you didn't have to predict market bottoms or time recessions at all?

The truth is, trying to invest at "the best possible times" is exactly what keeps most people from building real wealth.

They wait for the perfect entry. They hesitate during volatility. They overthink every decision.

Meanwhile, the people actually getting rich are doing something far simpler: they automated everything and stopped thinking about it.

Here's what automation actually does:

It removes you from the equation. Your emotions, your timing instincts, your fear of buying at the wrong moment—none of it matters when the system runs automatically.

You contribute the same amount every month regardless of what the market is doing. When prices are high, you buy fewer shares. When prices crash, you automatically buy more shares at a discount.

Over 20-30 years, this dollar-cost averaging beats market timing strategies in almost every historical scenario. Not because it's smarter—because it's consistent.

The real edge isn't timing. It's removing the ability to screw it up.

Set it up once. Let it run for decades. Build wealth while you focus on literally anything else.