- Solid Right

- Posts

- Great Crypto Awakening

Great Crypto Awakening

The Rules Are Changing

A Message From Our Sponsor … 🚀

Former PepsiCo Exec Invented A Plastic That Dissolves in Water

If anyone knows a thing about plastic’s impact on the planet, it’s Manuel Rendon. The former PepsiCo executive and environmental engineer is using his 20 years of expertise to solve one of the world’s biggest problems with Timeplast.

Up to 450 million metric tons of plastic are wasted each year. Microplastics seep into our bodies, and mountains of bottles pile up in the ocean. But Timeplast has patented a water-soluble, time-programmable plastic that vanishes without harming the environment.

Major players are already partnering with Timeplast for its patented technology—their sales grew 6,000% in the first month.

You have just a few days left to invest as Timeplast scales in its $1.3T plastic market, from packaging to 3D printing. Become a Timeplast shareholder by midnight, 7/31.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

GET IT RIGHT 🎯

Crypto’s Next Chapter 📚️

Something extraordinary is unfolding right under our noses — and no, it’s not another meme coin pump. While most retail investors were distracted by macro doomscrolling or licking wounds from the last cycle, Bitcoin quietly doubled in price over the past year. Earlier today, it hit a jaw-dropping $122,000. That’s more than 10 times the gain of the S&P 500.

Welcome to the Great Crypto Awakening — and it’s just getting started.

Enter: Smart Money 💰️

Big investors aren’t just nibbling at the edges anymore. Last week alone, digital asset investment products saw $3.7 billion in inflows — the second-largest on record — pushing total AUM to a staggering $211 billion. Even more telling? Long-term holders now control over 74% of Bitcoin’s supply, the highest in 15 years. Translation: they’re not trading. They’re locking in.

This isn’t speculative mania. It’s strategic positioning.

Regulatory Clarity 🌤️

Behind the scenes, Washington is getting its crypto act together. Three major bills are gaining traction:

The GENIUS Act would give private firms the green light to issue stablecoins.

The Clarity Act aims to end the turf war between the SEC and CFTC, finally giving crypto businesses a roadmap.

The Anti-CBDC Surveillance State Act would block state-run digital currencies — a big win for decentralized advocates.

If passed, this trio of bills could cement the U.S. as the global crypto capital.

Ethereum's Shine 💡

Bitcoin may grab headlines, but Ethereum is fast becoming the asset of choice for forward-thinking corporations. BitMine Immersion just stacked 163,000 ETH after a $250 million raise. SharpLink Gaming went even bigger — buying 10,000 ETH directly from the Ethereum Foundation, now holding over 222,000 ETH total.

This is the MicroStrategy playbook, Version 2.0 — but with ETH. And staking yields. And institutional swagger.

The Underdogs 🐕️

Two unexpected stars? Stellar (XLM) and Pudgy Penguins (PENGU).

Stellar surged 85% after PayPal chose its network for the PYUSD stablecoin. Its built-in bank-compliant “Anchor system” could make it a corporate darling.

Meanwhile, Pudgy Penguins — yes, the toy-store plushies — are up 92%, bridging Web3, gaming, and retail. Walmart. Target. A token. A game. It’s real-world adoption with waddle power.

The China Factor 🌏️

In a plot twist no one saw coming, China’s powerful state asset commission is hinting at a re-evaluation of crypto policy. Calls for “deeper research” into blockchain and stablecoins could be the start of something seismic. Keep your eyes on Shanghai — it often moves before Beijing does.

The Takeaway 🥡

This isn’t hype. It’s a structural shift. Institutions are piling in. Supply is drying up. Regulators are (finally) clearing the runway. Even China might be softening.

This is crypto’s coming-of-age moment.

And if you're paying attention — you're already ahead of the curve.

Welcome to the new financial order.

Alt Season Incoming? 💹

You haven’t been dumped yet… but the vibes are off.

The delayed replies. The memes left on read. The canceled fall getaway that’s suddenly “not a good time.”

You know something’s coming — and that’s exactly how this market feels right now. We’re not calling it alt season just yet… but man, we can feel it in the air.

Let’s break it down.

Altcoin Spotlight 🔍️

Over the past week, four altcoins in the top 10 have outpaced Bitcoin. That’s not nothing. When alts start bleeding outperformance into the highest ranks, it’s often the early whisper of a market rotation.

Smart traders are listening.

Altcoin Outpacers

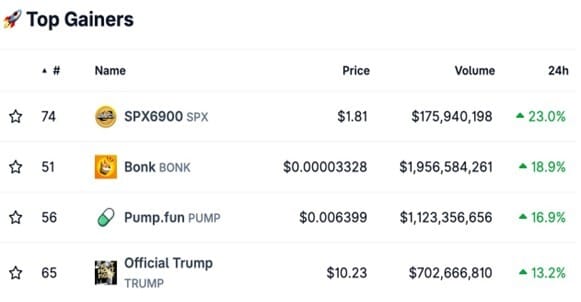

Daily Gainers 📈

Take a look at the 24-hour leaderboard. The biggest winners aren’t the polished, blue-chip projects — they’re memecoins and “memecoin-adjacent” plays. That’s classic risk-on behavior. When the degens start eating again, you know we’re not in Kansas anymore.Bitcoin Season Slides 🎚️

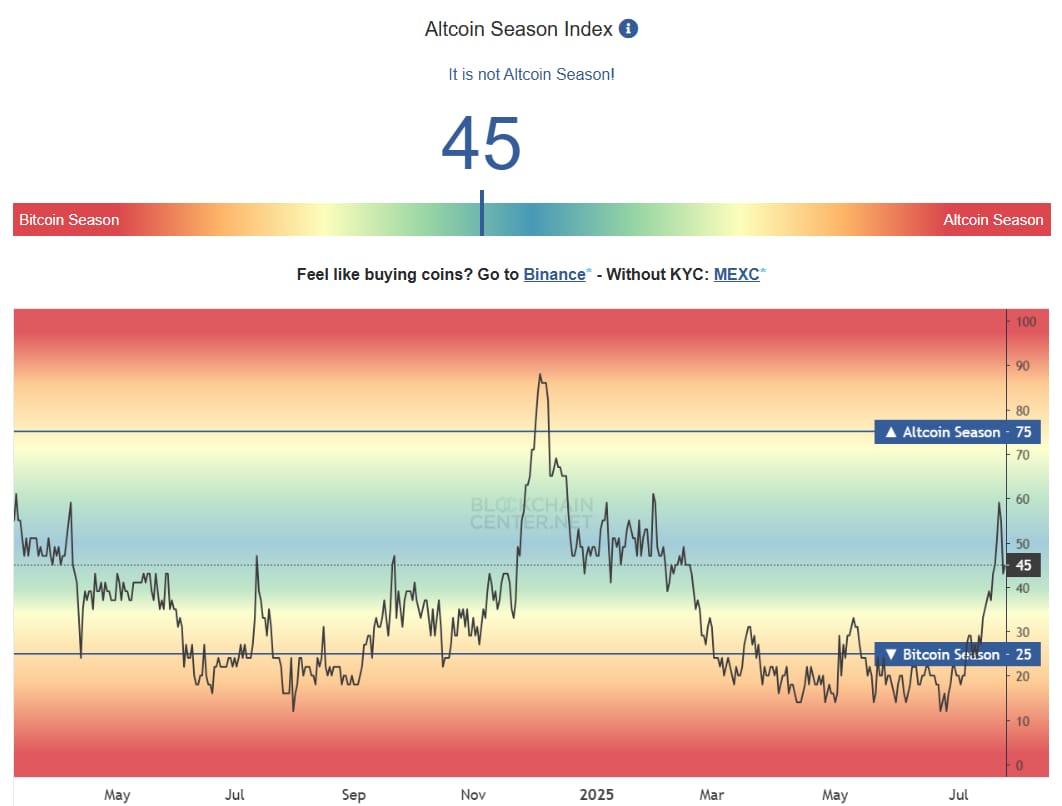

Technically, alt season begins when 75% of the top 50 coins outperform BTC over a 90-day window.

Bitcoin season ends when that number dips below 25%.

Right now? We’re sitting at 45%. That’s up big from 26% just days ago. In other words, we’re in altcoin limbo — but trending in the right direction.

TradFi's Gets Spicy 🌶️

It’s not just crypto. Traditional finance (TradFi) is showing the strongest uptick in risk appetite in 25 years. When the big boys start rolling the dice, you’d be wise to pay attention.

So… is it time to go all-in on frog coins and anime-themed tokens?Liquidity Rises 🚀

The real signal — the one seasoned investors watch like hawks — is the ISM Purchasing Managers Index (PMI). Historically, when the PMI crosses above 50 and global liquidity rises, we enter a full-blown risk-on environment.

Right now, PMI is still at 49…

…but global liquidity? It’s hovering near all-time highs.

That’s your yellow light turning orange.

Bottom line 📊

Alt season hasn’t officially arrived. But the music’s warming up, the DJ’s plugging in, and the dance floor is starting to fill.

So maybe hold off on the cabin trip… and start checking your bags for some well-positioned alt exposure instead.

COIN SPOTLIGHT 🔍️

Gaining Momentum ✈️

Momentum Finance (MMT) is quietly becoming one of the most influential projects in the Sui ecosystem, and it’s bringing serious upgrades to how DeFi works.

Launched in March 2025, Momentum is a next-gen decentralized exchange (DEX) built on the high-speed, low-cost Sui blockchain. And with over $6.3 billion in swap volume and $155 million in TVL already under its belt, it’s making waves far beyond its sleek UI.

So, what makes it different? Let’s break down the four features putting real momentum behind Momentum.

Concentrated Liquidity 🌊

Momentum ditches the old-school “spray and pray” liquidity model. Instead, it uses CLMM technology that lets liquidity providers target specific price ranges. Think Uniswap v3, but turbocharged on Sui. The result? Deeper pools, tighter spreads, and less slippage for traders.Win-Win System 🏆️

Drawing inspiration from Curve and Aerodrome, Momentum’s ve(3,3) governance model creates serious alignment across the ecosystem:

Protocols can bribe voters to attract liquidity.

Voters earn 100% of trading fees and bribes.

Liquidity providers earn all MMT emissions.

Traders enjoy lower fees.

It’s a rare setup where everyone wins — and that’s not something you see every day in DeFi.

Treasury Security 🚨

Security isn’t an afterthought here. Momentum’s multi-signature treasury controls, built using the Move language, require multiple approvals for big decisions. That means institutional-grade security for projects managing serious capital.A DeFi Pillar 🏢

Momentum isn’t just another DEX — it’s actually minting Sui-native stablecoins like Agora USD (AUSD) and First Digital USD (FDUSD). It’s helping build the monetary foundation of the entire Sui network.

Oh, and investors have noticed. Momentum recently raised $100 million in a strategic round led by OKX Ventures, with support from Coinbase Ventures, KuCoin Ventures, and others. That’s real capital backing real tech.

Starting Point 🎏

Momentum’s token (MMT) isn’t live yet — but you can start earning future rewards through its Bricks points system. By trading, providing liquidity, or referring others to the platform, users can rack up Bricks that convert into MMT during the airdrop.

The more active you are, the bigger your potential reward.

Bottom Line 📈

Momentum is more than hype. With smart tokenomics, strong backing, and serious traction on a fast-growing blockchain, it’s worth watching — and possibly worth earning your way into.

STAGE RIGHT 🎬️

NOTABLE QUOTES 📚️

“Do not spoil what you have by desiring what you have not: remember that what you now have was once among the thigs you only hoped for.”

— Epicurus

GARAGE LOGIC ☕️

Increase Your Agency 🍸️

To have agency means to possess the capacity to act independently, to make choices, and to exert control over one’s own life. It is the ability to shape one’s destiny rather than merely being shaed by external forces. Agency involves will, autonomy, and responsibility — the power to define one’s self and pursue one’s values in a world that often resists such efforts.

READ THE FULL STORY.

FINAL SPIN 📽️

LAST CHAPTER 📺️

Be sure to check out Solid Right VIP It’s your inside track to the latest moves in Ethereum, Bitcoin, and beyond—delivered with clarity, context, and zero hype.

Join now and get 50% off forever. Go HERE.

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive