- Solid Right

- Posts

- Crypto's Next Boom

Crypto's Next Boom

Where Real Growth Hides

A Message From Our Sponsor … 🚀

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

GET IT RIGHT 🎯

Rise of the Apps 💵

Let’s be honest — the crypto market right now feels like a caffeine-deprived roller coaster. Tariff shocks, macro mood swings, and your favorite token doing its best impression of a heart monitor. But beneath all that noise, something much bigger is happening — a quiet, ruthless war for revenue.

Not the headline-grabbing “Layer-1 vs. Layer-2” turf wars we’ve all watched. That battle’s basically over. The new front is the application war — and it’s reshaping where the real money flows in crypto.

Great Blockchain Divide ⛓️

Once upon a time, everyone was obsessed with blockchains that could process a billion transactions for the price of a stale coffee. Speed and cost were everything. But cheap doesn’t always mean profitable.

The data paints a clear picture: only dominant or specialized chains are thriving. Hyperliquid 1 (HYPE) — built solely for a perpetuals exchange — saw record fees this fall. BNB Chain is also back from the dead, pulling in $70.6 million in application revenue in October, its best showing since 2022.

Meanwhile, most other chains are quietly bleeding. Fees are dropping faster than usage is rising. Why? Because in the race to be “the fastest and cheapest,” they accidentally built blockchains that are… well, too cheap to sustain themselves. Lower fees mean lower security budgets. Lower security means fewer users. Rinse and repeat.

And to make things worse (or better, depending on your portfolio), the markets are now run by pros and bots, not retail investors with diamond hands and emotional baggage. These smart operators don’t overpay or make inefficient trades — which also means they don’t generate juicy fee revenue.

Result: the base-layer blockchains are turning into dull utilities, while the applications sitting on top are quietly printing money.

Eating the Chains 🐻

This shift is crystal clear in the numbers.

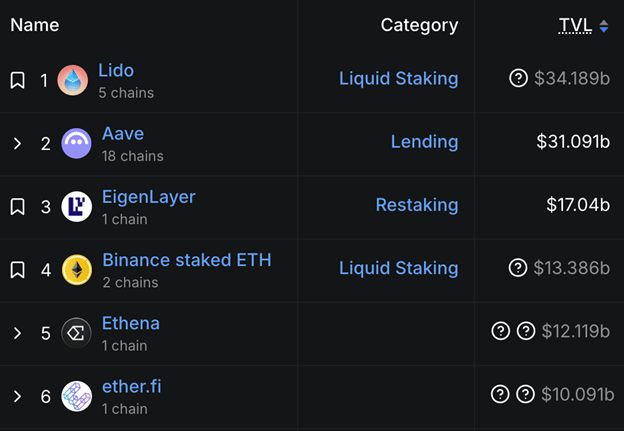

DeFi’s total value locked hit $172.9 billion — the highest in four years. Stablecoins are flexing with a $306.9 billion market cap. DEX volumes? A record $178 billion in a single week.

But the real winners? Lending protocols.

Aave raked in $99 million in fees in September alone. Morpho and Spark aren’t far behind. Boring? Maybe. Profitable? Absolutely. DeFi’s cash cows are churning while the base layers graze in the background.

Users supplying liquidity to these platforms are literally getting a slice of the action — the DeFi version of passive income, minus the “set it and forget it” comfort. Because nothing says relaxation like refreshing your yield dashboard every six minutes.

Staking Grows Up 🪴

Ethereum remains the king of staking, but even the throne is getting crowded. Mainnet yields are drying up as the action shifts to Layer-2s and newer staking models. Lido’s revenue has cooled since its peak, while upstarts like Binance Staked ETH and EtherFi are tripling their monthly earnings by taking on more risk — and offering juicier rewards.

Translation: simple staking is out. Complex, risk-laden strategies are in. Welcome to the new normal.

The New Reality 👓️

Infrastructure is boring. Applications are where the growth — and the fun — now lives. The big money is no longer in betting on which chain runs faster. It’s in finding the apps that make those chains matter.

So while everyone else is still arguing over Layer-1s versus Layer-2s, the smart money has already moved on — hunting yield in the chaotic, messy, and wildly profitable frontier of crypto applications.

Welcome to the new crypto order: boring chains, exciting apps, and endless opportunities… for those paying attention.

Future of Banking 🏦

Traditional banks are the financial equivalent of dial-up internet — slow, noisy, and somehow still charging you for the privilege. Enter neobanks — sleek, app-based platforms that let you send money, earn yield, and manage accounts without ever stepping foot into a marble-floored lobby.

And now, thanks to blockchain, they’re going full super-saiyan.

Rise of Neobanks 🚀

At their core, neobanks are digital banks — no branches, no paper forms, just your phone and a few taps. But when you throw blockchain into the mix, things get interesting.

The traditional system is expensive and fragmented (try sending money overseas without paying a small fortune). Crypto exchanges improved access but stopped short of acting like real banks. Neobanks bridge that gap — combining crypto’s openness with the convenience of digital banking.

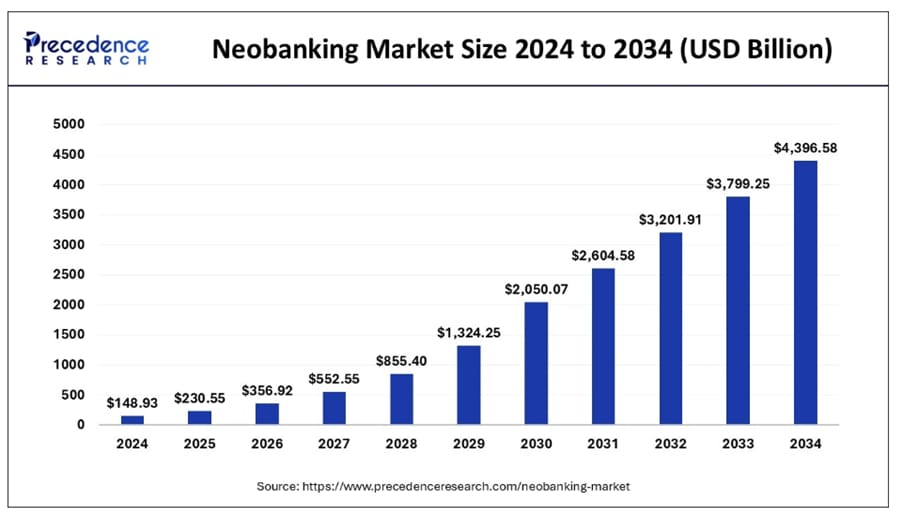

That combination has investors drooling. The global neobanking market hit roughly $149 billion in 2024 and is projected to balloon past $4 trillion by 2034 — growing at a pace that would make your favorite memecoin jealous. And by 2026, nearly 40% of neobanks will offer crypto services to millions of users who’ve realized their “regular” banks are just glorified spreadsheets.

Meanwhile, stablecoins — once seen as crypto’s boring cousins — have quietly become the payment rails of the internet. With a $250 billion+ market cap and more daily transaction volume than Visa or Mastercard, they’re already running the global show.

Meet UR by Mantle 💴

Leading the charge is UR, Mantle’s blockchain-based neobank. Think of it as your bank account, but fluent in crypto.

Operating under Swiss regulations (because, of course, it’s Swiss), UR offers verified accounts with multi-currency IBANs and 1:1-backed deposits — so your funds are as real as they are digital. It plugs directly into Mantle’s DeFi ecosystem, offering perks like:

Up to 5% APY on USDe via Ethena Labs — no gimmicky promo rates here.

Zero off-ramp or transfer fees.

Cross-network transfers through SWIFT, SEPA, and major crypto chains like Ethereum and Arbitrum.

A Mastercard debit card that seamlessly swaps between fiat and stablecoin balances like it’s 2030 already.

UR’s model creates a neat feedback loop: user deposits deepen liquidity, which boosts yields, which attracts more users — you get the picture.

As Mantle’s Global Head of Strategy, Timothy Chen, summed it up:

“We’re not just building a crypto neobank — we’re prototyping the next generation of financial institutions.”

The Crowd Forms 🏟️

UR isn’t alone. Plasma One targets emerging markets with zero-fee transfers. Tria caters to crypto purists. EtherFi Cash merges yield with payments. Galaxy One and the MetaMask Card are hot on their heels.

Behind them, major banks are quietly building the plumbing: Citi with tokenized deposits, HSBC with blockchain gold, and new Basel regulations that finally let banks hold crypto without fainting.

The Bigger Picture 🖼️

DeFi proved what’s possible. Stablecoins made it practical. Neobanks are making it usable.

They’re the bridge between your crypto wallet and your morning coffee — the point where TradFi finally admits DeFi had a better UX all along.

And if UR’s momentum is any indicator (Mantle’s daily volume up 120% in October, transactions nearly 80,000 per day), this is just the beginning.

Welcome to the future of finance — where your “bank” lives on-chain, your yield comes from protocols, and your debit card speaks fluent Ethereum.

COIN SPOTLIGHT 🔍️

Token Buyback Boom 🧨

Let’s be real — if your project has so much extra cash that you’re literally buying back your own tokens instead of fixing bugs or hiring that one dev who “went camping and never came back,” you’re probably doing something right.

Buybacks are crypto’s version of a victory lap — the market’s way of saying, “Yeah, we’re making money over here.” They signal strong product-market fit, actual revenue, and, occasionally, a healthy ego. But not all buyback schemes are created equal. Some burn supply forever. Others… just pat themselves on the back and keep circulating.

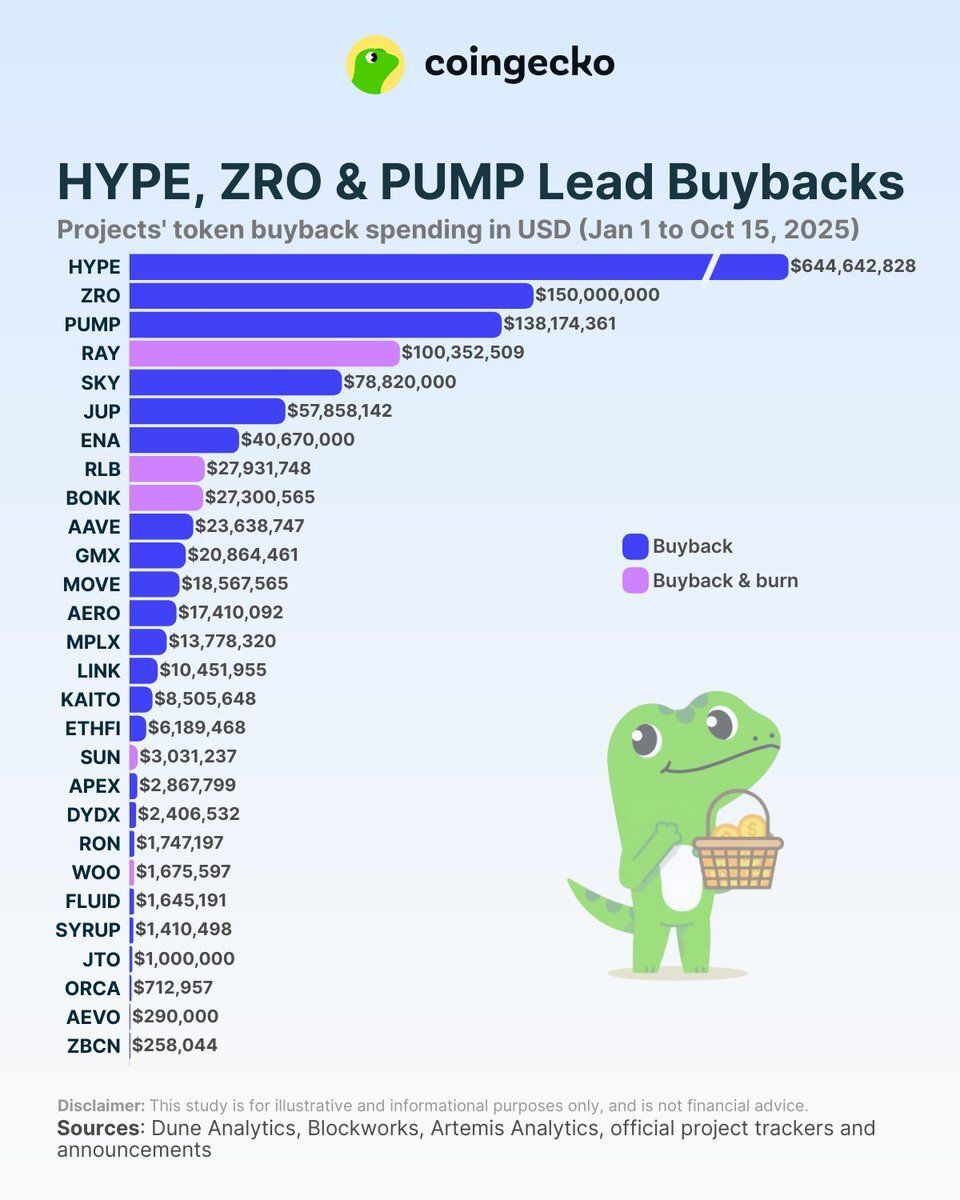

So, here are the top five crypto projects leading 2025’s buyback bonanza — plus what makes each one tick.

1. Hyperliquid ($HYPE) 🌊

Bow down to the buyback king. Hyperliquid didn’t just top the list — it dominated it. Nearly 46% of all crypto buybacks in 2025 came from $HYPE alone. That’s not a typo.

Their model is simple: revenue-funded buybacks with partial burning. Translation: they use actual income, not VC magic beans, to buy tokens — and then nuke a portion of them permanently. So far this year, they’ve vaporized 2.14% of total supply, proving once again that liquidity isn’t the only thing they’re hyper about.

2. LayerZero ($ZRO) 0️⃣

Ah yes, the flashy one-time wonder. LayerZero pulled off a $150 million buyback — roughly 5% of its total supply — and promptly dropped the mic.

No burns, no recurring plan, just a single statement piece. It’s like when a startup buys a Super Bowl ad: bold, expensive, and probably unnecessary… but everyone noticed.

3. PumpFun ($PUMP) ⛽️

The name says it all. $PUMP only started its buybacks in July and is already averaging $40.47 million per month. That’s impressive momentum — especially for something literally called PumpFun.

Their buybacks are funded by transaction fees, and none of the tokens are burned. So yes, the supply remains the same… but the vibes are immaculate.

4. Raydium ($RAY) ☀️

If buybacks were a sport, Raydium would be the grizzled veteran still dunking on rookies. They’ve been at this since 2022, racking up $202 million in total buybacks and permanently burning 4.3% of supply this year alone.

Raydium isn’t just playing the long game — they invented the long game. The project’s been quietly cleaning up its own supply for years, proving that consistency beats hype every time.

5. Sky ($SKY) 🌦️

Sky earns points for creativity. Instead of just torching tokens, its Smart Burn Engine recycles them — feeding $SKY into staking rewards for its ecosystem.

It’s basically token composting: good for the environment, great for holders. And yes, we hold $SKY in the All Access Portfolio — for good reason.

The Takeaway 🥡

At the end of the day, buybacks are about one thing: supply reduction. Fewer tokens = greater scarcity = potential price lift.

But beyond the charts, they’re also a sign of maturity — projects moving from “please notice us” to “we’re running a real business.”

So the next time a token announces a buyback, don’t just shrug. It might be the quiet flex of a project that’s actually figured it out — or, at the very least, one that can afford to pretend it has.

STAGE RIGHT 🎬️

NOTABLE QUOTES 📚️

“The problem creates the solution. What stands in the way becomes the way.”

— Marcus Aurelius

GARAGE LOGIC ☕️

Most Harmful Foods 🥐

After two decades treating heart disease, clogged arteries, and metabolic dysfunction, I began to notice a pattern. Many of my patients thought they were doing everything right — like exercising regularly and managing stress — yet they still ended up in my office with serious cardiovascular issues.

The common thread? Everyday food choices. Read the full article.

FINAL SPIN 📽️

LAST CHAPTER 📺️

Introducing:

CHERRY BLASTER

This versatile energy and focus supplement offers the perfect pre-workout boost or for anyone needing sustained mental clarity throughout the day. Whether you’re pushing through an intense workout, a demanding workday, or simply seeking an energizing lift, Cherry Blaster keeps you sharp and fueled.

ORDER HERE.

SOLID RIGHT VIP 🗝️

Be sure to check out Solid Right VIP It’s your inside track to the latest moves in Ethereum, Bitcoin, and beyond—delivered with clarity, context, and zero hype.

Join now and get 50% OFF forever. Go HERE.