- Solid Right

- Posts

- Bitcoin Breaks

Bitcoin Breaks

October Surge?

A Message From Our Sponsor … 🚀

SOLID RIGHT VIP 🗝️

Be sure to check out Solid Right VIP It’s your inside track to the latest moves in Ethereum, Bitcoin, and beyond—delivered with clarity, context, and zero hype.

Join now and get 50% OFF forever. Go HERE.

GET IT RIGHT 🎯

Momentum Shift 🚀

If you’ve been staring at your portfolio with the same enthusiasm as watching paint dry, good news: October is here, and crypto finally remembered how to party.

Bitcoin just ripped past $117,000 to kick off the month—because apparently, the calendar alone is a bullish signal. “Uptober” is living up to its name, and the ride is only getting started.

The Fed’s Gift 🎁

The U.S. economy is wheezing harder than a retiree climbing three flights of stairs. ADP’s September jobs report showed private payrolls dropping by 32,000—the sharpest plunge in two and a half years. Normally, this would be a problem. For crypto? It’s champagne and fireworks.

The Fed is now boxed into cutting rates again. Futures are pricing in a 99% chance of another trim in October. Translation: investors need yield, and crypto is serving it piping hot.

Gold set a fresh record at $3,921, and Bitcoin is strutting right alongside it as “digital gold.” Two different outfits, same safe-haven runway walk.

Smell the FOMO 🍾

September ended with Bitcoin posting a 5.16% gain—the third-best September on record. Apparently, that was enough for Wall Street to stop sulking and start buying.

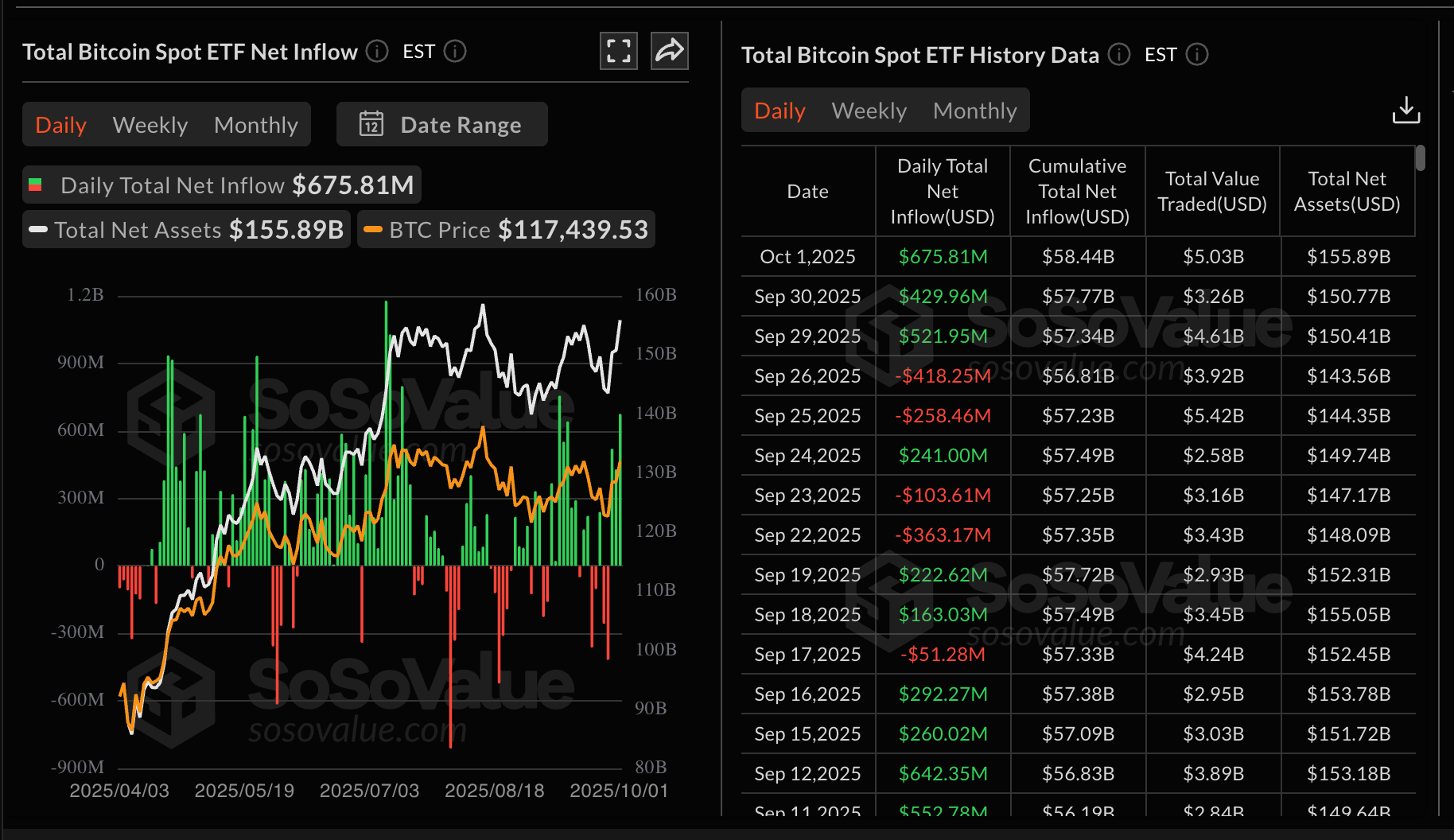

Spot Bitcoin ETFs saw $950 million in inflows in just two days, erasing a week’s worth of outflows like it never happened. Ethereum ETFs weren’t shy either, racking up $127 million in one day with zero redemptions.

ETF Inflows

And then there’s Japan’s Metaplanet, which decided to cosplay as MicroStrategy and dropped $616 million on 5,268 BTC at $116,870 a pop. Their stack now totals 30,823 BTC worth $3.33 billion—up 497% year-to-date. Corporate FOMO: it’s not just an American pastime anymore.

Cue the Music 🎼

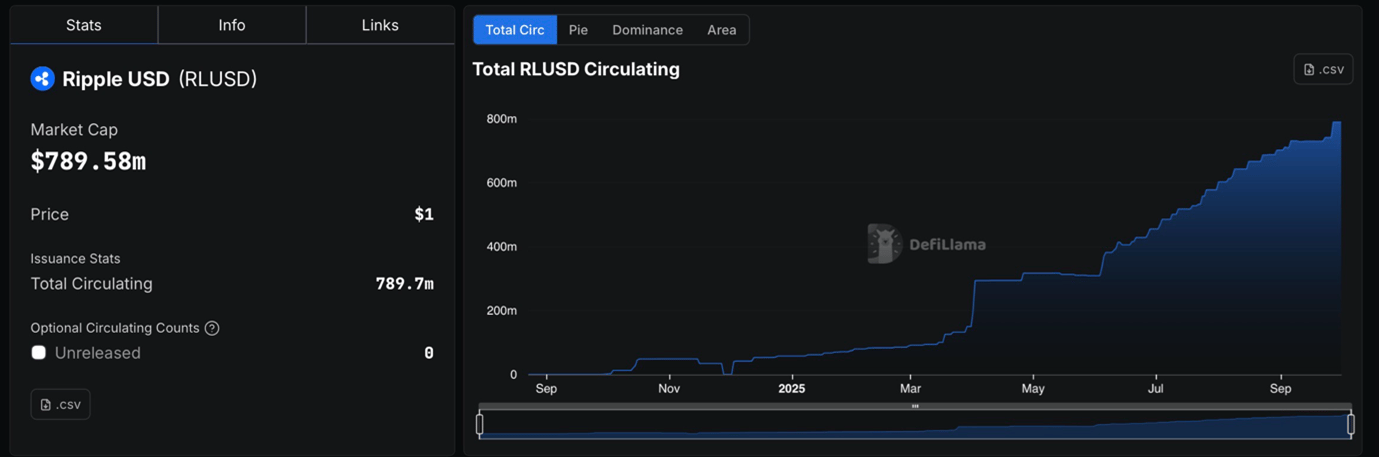

Meanwhile, BlackRock, VanEck, and Securitize linked arms with Ripple to plug its RLUSD stablecoin into tokenized money-market funds. In English: institutions can now glide between fiat and stablecoins like it’s an airport moving walkway. RLUSD already hit $700 million in circulation, fully backed and NYDFS-blessed.

RLUSD

Even the Trump clan is leveling up. At TOKEN2049, World Liberty Financial announced plans for a crypto debit card pilot by 2026. Because if there’s anything the world needs, it’s Don Jr. telling you how to spend your stablecoin. Love them or hate them, it’s mainstream adoption with hairspray.

Altcoin Season Watch 🍂

Macro analyst Noelle Acheson says the next bull cycle is warming up, with liquidity set to spill into alts. That’s the part where Bitcoin and Ethereum gains start looking quaint compared to what your neighbor’s random mid-cap coin does.

The numbers agree: the total crypto market cap just hit $4 trillion with $164 billion in daily trading volume. Momentum isn’t coming—it’s already here.

So buckle up. This ride doesn’t have seatbelts, but it does come with moon-sized upside.

Finding Your Strategy 🧿

So, you want to “make the crypto market work for you”? Great. That’s like saying you want to make a cat obey commands. Possible? Sure. Easy? Absolutely not. But with the right strategy, you can at least keep your portfolio from scratching the couch to pieces.

The first step is knowing what kind of investor you are:

Short-term thrill seeker (a.k.a. “degen lite”).

Long-term believer (a.k.a. the human version of diamond hands).

Let’s break it down.

Short-Term Gains 📈

Degens (short for “degenerates”) are the Evel Knievels of crypto. They stare at volatility, whisper “send it,” and dive in headfirst. Fundamentals? Nah. They live and die by charts, momentum, and the hope that today’s memecoin isn’t tomorrow’s rug pull.

Take Bonk (BONK), Solana’s viral pup token. It launched at a laughable $0.00000008614 in late 2022 and somehow clawed its way to $0.00002081. That’s a 22,939% gain—the kind of math that makes accountants cry.

BONK

But before you quit your job to chase dog coins, know this: most of them flatline before you can say “to the moon.” If you want to play degen lite:

Cast a wide net. Sprinkle small bets across many projects. One moonshot might pay for the other nine duds.

Be fast. Memecoin markets move quicker than your boss realizing you’re trading on company Wi-Fi.

This isn’t investing—it’s crypto speed-dating. Fun, risky, and occasionally profitable if you don’t mind heartburn.

True Believers 🔮

On the other end, we’ve got the patient monks of crypto—the “HODLers.” These are the folks who don’t sell when Bitcoin drops 30% overnight. They meditate, sip tea, and wait.

Case in point: Buying 1 BTC in January 2020 cost you $7,410. Fast-forward five years, and it’s worth $112,881. That’s a 1,423% increase without lifting a finger (except maybe nervously refreshing CoinGecko during dips).

BITCOIN

The magic here isn’t luck—it’s conviction. Believers trust blockchain like it’s gospel. But diamond hands come with fine print:

You need research chops to separate gems from scams.

You need the discipline not to panic-sell when headlines scream “Crypto Dead Again.”

And you need patience, because gains might take years.

It’s not glamorous, but it works. Slow and steady doesn’t just win the race—it cashes out while the degens are still chasing dog mascots.

Three Tools 🛠️

Whichever camp you fall into, you’ll need the right gear:

Narrative trackers (like DeFi Llama). Free, simple, and perfect for spotting hot market themes.

Social media sentiment. Yes, Twitter can be a cesspool, but it’s also the heartbeat of crypto hype. Learn to read it.

Artemus Ratings. Think of it as Yelp for tokens. Ratings, alerts, and customizable lists help you track what matters without drowning in noise.

The Takeaway 🥡

Crypto’s a choose-your-own-adventure story. You can be the adrenaline junkie chasing memecoin jackpots, or the stoic monk stacking sats and waiting for the decade payoff. Either way, the key is using the right tools, staying informed, and—most importantly—not fooling yourself into thinking this is “easy money.”

COIN SPOTLIGHT 🔍️

Tracking Market Gains 🗺️

Gather round, fellow degens and diamond-handed dreamers—it’s time for our 30-day crypto temperature check. Think of it as speed-dating with market sectors: some are looking like long-term partners, others are that one friend you regret texting at 2 a.m. Either way, here’s who’s hot right now.

Staking Services (+32.6%) 🗽

This “sector” is basically EigenCloud bench-pressing the entire weight class by itself. Yes, Google Cloud announced a shiny new partnership with Eigen, but the price didn’t care. The real juice? The Fed’s latest rate cut. Because nothing makes digital validators sexier than Jerome Powell mumbling about economic weakness.

Artificial Intelligence (+30.4%) 🤖

Once again, one token is dragging the whole gang into the green. Enter Worldcoin, the eyeball-scanning wonder project you either love or fear. It ripped higher after Eightco Holdings decided to throw $250 million into a Worldcoin treasury. Translation: corporate FOMO is alive, well, and apparently funded by people who enjoy staring into silver orbs.

NFT Applications (+24.1%) 🎨

Remember NFTs? Those jpegs you bought in 2021 that are now worth less than your gym membership? Well, they’re back—kind of. As investors tire of “serious” assets, they’re sliding down the risk curve and poking around for zombie sectors that might twitch back to life. Forgotten assets? Check. Bull market nostalgia? Double check. Cue the NFT revival tour.

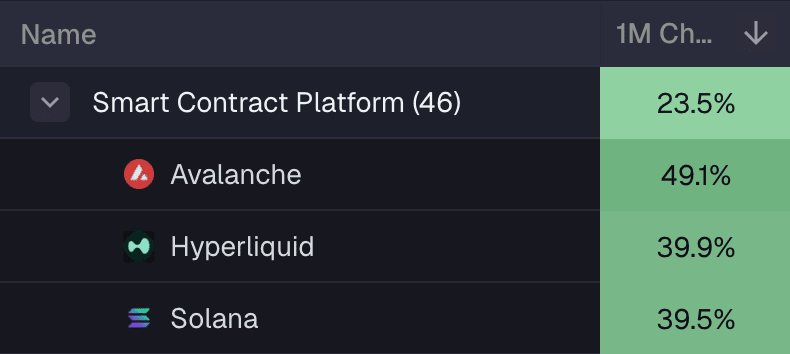

Smart Contracts (+23.5%) 📒

Avalanche and Solana both scored billion-dollar investment announcements. Hyperliquid casually dropped a $500 million treasury update and unveiled its own stablecoin, $USDH, like it’s launching a new flavor of soda. When treasuries this big hit the market, you know the grown-ups are moving in.

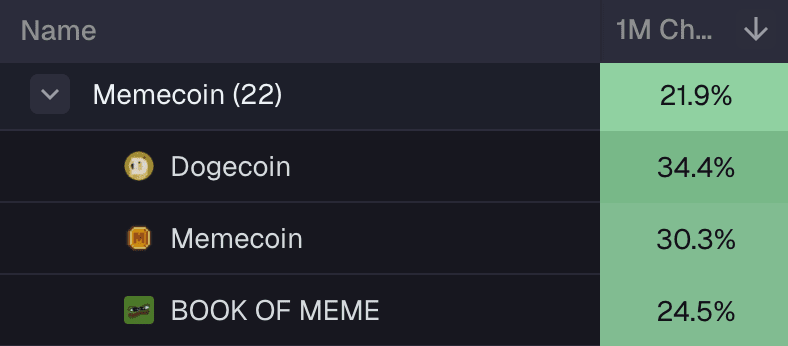

Memecoins (+21.9%) 🐶

And finally, the chaos corner. Dogecoin got its first U.S. ETF (yes, the coin that started as a Shiba Inu joke now has an exchange-traded fund). Meanwhile, the broader memecoin narrative picked up steam heading into the Fed’s rate cuts. Because nothing says “economic uncertainty” like panic-buying coins with cartoon mascots.

Mile-High View 🪂

Notice a theme? Most of these sectors sit way out on the risk curve. And yet they’re pulling in TradFi dollars like never before:

Worldcoin with its $250M treasury.

Avalanche and Solana with billion-dollar backing.

Hyperliquid with $500M in dry powder.

Dogecoin finally getting the ETF treatment.

It’s a simple equation: risk appetite up = crypto rockets engage.

The Takeaway 🥡

The broader takeaway? The market is moving from cautious optimism to full-blown “risk-on” mode. And when that happens, crypto doesn’t just perform—it struts around like it owns the place.

So buckle up. This market just went from lukewarm to flaming hot in 30 days—and the party’s only getting started.

STAGE RIGHT 🎬️

NOTABLE QUOTES 📚️

“Tolerance will reach such a level that intelligent people will be banned from thinking so as not to offend the imbeciles.”

— Fyodor Dostoevsky

GARAGE LOGIC ☕️

Hollywood Slams AI Actress 🤖

Leading actors labor union SAG-AFTRA recently condemned the rise of Tilly Norwood, an AI-generated “actress” developed by London-based Xicoia, calling the synthetic performer a threat to human entertainers. The character, developed by comedian and technologist Eline Van der Velden—was unveiled at the Zurich Summit during the Zurich Film Festival in Switzerland, and immediately drew online attention. Van der Velden said multiple talent agents are already interested in signing the artificial personality. Read the FULL STORY.

FINAL SPIN 📽️

LAST CHAPTER 📺️

Introducing:

CHERRY BLASTER

This versatile energy and focus supplement offers the perfect pre-workout boost or for anyone needing sustained mental clarity throughout the day. Whether you’re pushing through an intense workout, a demanding workday, or simply seeking an energizing lift, Cherry Blaster keeps you sharp and fueled.

ORDER HERE.

SOLID RIGHT VIP 🗝️

Be sure to check out Solid Right VIP It’s your inside track to the latest moves in Ethereum, Bitcoin, and beyond—delivered with clarity, context, and zero hype.

Join now and get 50% OFF forever. Go HERE.