- Solid Right

- Posts

- Altcoin Season

Altcoin Season

Your Roadmap

A Message From Our Sponsor … 🚀

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

GET IT RIGHT 🎯

Chasing Unicorns 🦄

If you’ve been around the blockchain once or twice, you’ve heard whispers of Altcoin Season—the mythical window when coins that aren’t Bitcoin stop sulking and start sprinting. If this is your first bull market, buckle up and hide your keyboard from your inner degen.

Here’s the pattern—when Bitcoin (BTC) runs, the market jogs behind it like an overeager golden retriever. When BTC stumbles, altcoins face-plant harder. But at a certain point, liquidity stops worshiping at the House of Satoshi and wanders over to Ethereum (ETH). From there it trickles into blue chips, then smaller projects, and finally into coins that were clearly named by a marketing committee on its third espresso.

Early Rotation

This rotation is why people lose their minds: we’ve seen alts outrun BTC by hundreds of percent—sometimes more. It’s also why “When altseason?” is the most common phrase after “gm” and “Wen Lambo.”

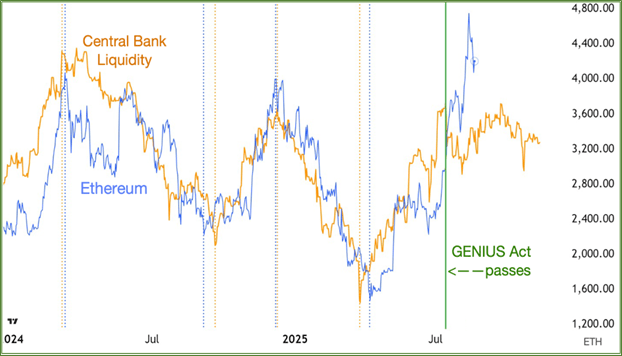

So, when does the next one actually show up? Short answer: follow Ethereum and a very unsexy macro input—Central Bank Liquidity (CBL). Yes, we’re talking about money printers, not moon memes.

Historically, ETH’s major highs and lows sync eerily well with CBL (forward-shifted ~24 weeks). As CBL made lower highs and lows, so did ETH—until mid-July, when the GENIUS Act gave stablecoins an official seat at the global dollar table. Translation: institutions got the green light to move serious capital where stablecoins live—on Ethereum. ETH promptly started ignoring flatlining liquidity like a teenager ignoring chores.

CBL Chart

Is ETH about to smash its old ~$5,000 high and drag a curated basket of alts with it? The price action says “quite possibly,” but keep your expectations caffeinated, not drunk:

ETH must hold the breakout. A flirtatious wick above the old high is cute. We need decisive closes above it. Sustained strength = higher odds of spillover to alts.

Altseasons need liquidity + a catalyst. In 2020, we had both (CBL firehose + DeFi boom). Today, we’ve got catalysts (GENIUS Act, ETH ETFs, TradFi balance sheets sniffing select alts). What we don’t have—yet—is a renewed CBL surge.

This is an institutional cycle. The big money buys what compliance will tolerate. That’s a tiny slice of “institutional-grade” alts with real revenue, users, or both.

Institutions don’t FOMO. They allocate—slowly. Expect a surgical altseason, not a piñata party.

Bottom line: early rotation is underway. ETH is breaking character from liquidity. If CBL turns up, the move could accelerate. If not, expect a tight, utility-first rally that barely budges the usual “alt vs. BTC” gauges—but quietly mints winners for those looking in the right places.

Fed Drama: Powell Winks 📈

Last month, Jerome Powell shuffled onto the stage in Jackson Hole, Wyoming, gave the world’s most carefully worded wink, and hinted that maybe—just maybe—the Fed would cut rates in September. Cue the fireworks.

Bitcoin spiked 4% in hours. Stocks marched toward all-time highs. Gold sparkled like your grandma’s earrings. And the dollar tripped over its shoelaces.

But here’s the thing: markets were already pre-gaming. Powell could’ve read the Cheesecake Factory menu aloud and traders would have cheered, as long as he didn’t slam the door on a rate cut. Why? Because nearly every other central bank has already been slashing rates for two years. Gold, stocks, and Bitcoin all ripped higher without the Fed’s blessing. Imagine the chaos when the biggest money printer finally joins the party.

Enter the Drama 🏟️

Then came the weekend twist. President Trump “fired” Fed Governor Lisa Cook. Her lawyer insists he can’t legally do that, so this one’s going to court. Markets, being the drama queens they are, didn’t wait for the verdict. Bitcoin plunged from $117K on Friday to under $110K by Tuesday.

Investors scratched their heads—wasn’t a rate cut good news? Yes. But not if it looks like politicians are yanking the Fed’s strings like a bad puppet show. The market hates the idea of election-season rate candy turning into inflation-induced indigestion. Remember the old line about the Fed’s job being to take away the punch bowl just when the party gets fun? Yeah, that.

Strange Disconnect ♊️

Here’s where it gets interesting. Central Bank Liquidity (remember that?)—the trusty “is there free money sloshing around?” gauge—has been rising since early August and should keep climbing until late September. In theory, Bitcoin should be cruising higher alongside it. Instead, BTC face-planted. This is the first time all cycle that rising CBL hasn’t given Bitcoin a lift.

Translation: markets are spooked by Fed independence theater, not liquidity.

What Happens Next 🔮

I still expect Bitcoin to resume its uptrend into late September. But don’t expect fireworks right away. My timing model pegs Sept. 13–20 as the next big crypto pivot. And smack in the middle—Sept. 17—Powell is expected to make his rate call. Classic setup for a “buy the rumor, sell the news” move: rally before the announcement, limp after.

So yes, Bitcoin’s pullback looks dramatic on the chart. In reality? It’s more of a caffeine break before Q4’s main event. Meanwhile, keep an eye on altcoins. When they start running, it’ll be like trying to catch a moving train—you don’t want to be the guy chasing it from the platform.

COIN SPOTLIGHT 🔍️

3 Beta Plays ✈️

There’s been a lot of chatter lately about Solana’s breakout potential, with three big catalysts in focus. One of them? “Public Solana treasury announcements from major players ($1B+).” Well, guess what—box checked.

Solana’s been flexing harder than most of the market lately, and those announcements are a big reason why. But here’s the real question: how do you ride this wave without just buying $SOL and hoping for the best? Enter beta plays—smaller, spicier tokens that tend to amplify the move when big catalysts hit.

Think of it like this: when corporations start building Digital Asset Treasuries (DATs), the playbook goes → buy $SOL → stake or lend it → earn yield → rinse, repeat. The platforms enabling that yield? They’re the ones most likely to get juiced.

And that’s where our Top 3 beta plays come in.

1. Jito ($JTO) ⌚️

Meet the king of liquid staking on Solana. Liquid staking lets you earn rewards without locking up your $SOL in a digital dungeon. Instead, you swap into $JitoSOL, which grows with staking rewards and stays usable across DeFi. Think of it as staking with benefits—like getting dessert without paying extra. If DATs pile billions into staking, Jito is first in line to cash in.

JTO

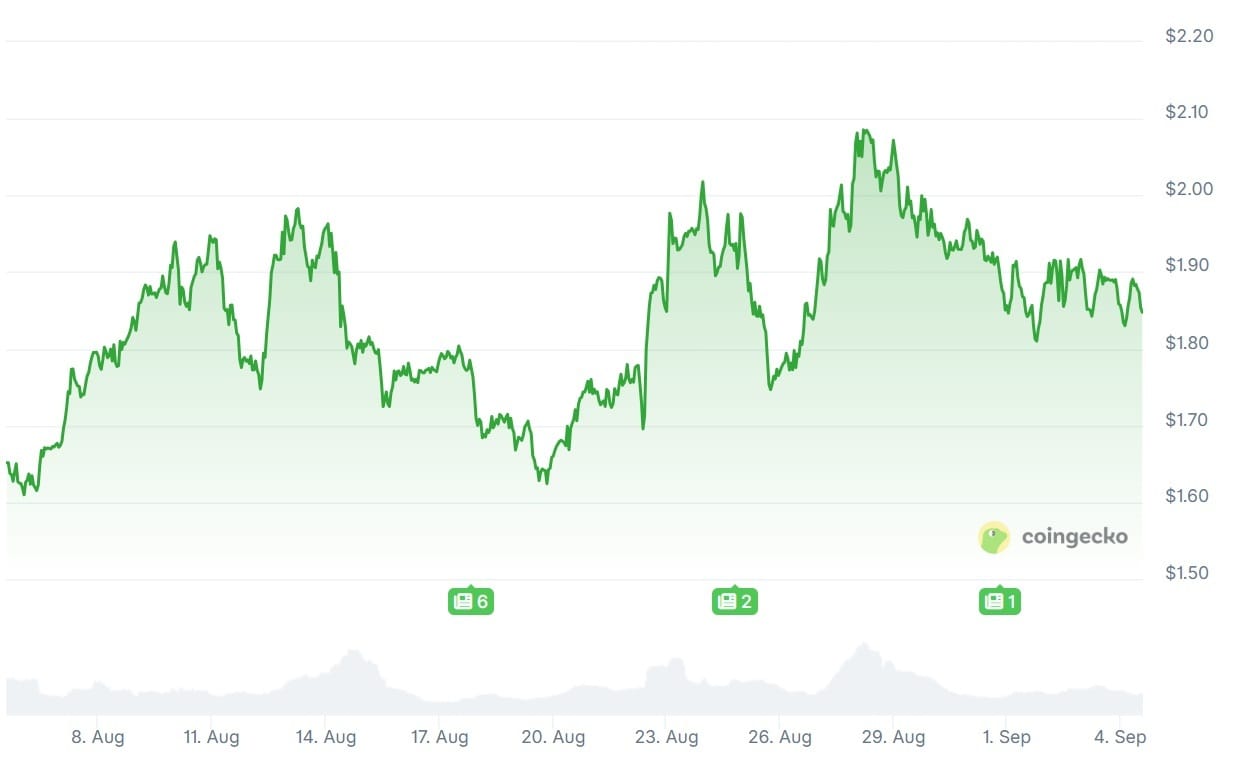

2. Kamino ($KMNO) 🎈

Kamino runs Solana’s biggest lending market… which, to be fair, is like being the tallest kid in kindergarten. At just $148M market cap (FDV ~$558M), it’s still tiny compared to Ethereum’s giants. But here’s the kicker: even a modest $150M bump doubles its token value. And if DATs fuel a lending boom? Kamino could turn into one of the loudest “why didn’t I buy that” stories of the year.

KMNO

3. Jupiter ($JUP) 🌑

Jupiter already wears a lot of hats—DEX, launchpad, liquid staking—and now it’s launching lending too. Basically, it’s the Swiss Army knife of Solana DeFi. One token, multiple revenue streams, and perfect timing to catch the DAT wave. It’s like showing up at a party with chips, salsa, and a six-pack—you’re getting invited back.

JUP

The Math ➕

If $3B of $SOL flows into these DATs, here’s what it could look like:

Solana: +0.88% (meh)

Jupiter: +64% (now we’re talking)

Jito: +135% (spicy)

Kamino: +675% (bring a fire extinguisher)

That’s the beauty (and the curse) of beta plays. Higher risk, higher reward. These tokens could moon—or face-plant.

So keep your head straight. Beta plays aren’t for the faint of heart. But if Solana’s DAT narrative keeps heating up, these three could be your golden ticket… or at least the ride of the season.

STAGE RIGHT 🎬️

NOTABLE QUOTES 📚️

“We are faced with the paradoxical fact that education has become one of the chief obstacles to intelligence and freedom of thought.”

— Bertrand Russell

GARAGE LOGIC ☕️

Bitcoin Blockbuster? 📽️

Documentaries have so far failed to identify Bitcoin’s pseudonymous creator, Satoshi Nakamoto, convincingly. Now, an upcoming feature film from notable Hollywood creatives aims to put a dramatic spin on the crypto’s creation and impact. Hollywood is turning its lens towards crypto with "Killing Satoshi," a conspiracy thriller that will explore the secret identity of Satoshi Nakamoto. Read the FULL STORY.

FINAL SPIN 📽️

LAST CHAPTER 📺️

Introducing GLP-XTREME: discover the natural, convenient, and affordable way to reach your dream weight. HERE.

Achieving your weight loss goals has never been easier. Say goodbye to endless cravings, ineffective diets, and expensive programs. Go HERE.